what is tax planning and management

Tax planning devises a persons financial affairs by taking advantage of all the allowable deductions exemptions allowances and rebates. Tax Management relates to Past.

Pdf The Impact Of Deferred Tax Expense And Tax Planning Toward Earnings Management And Profitability Semantic Scholar

Tax planning and management objectives.

. Tax planning is an action that is taken in the present but relates to the future. Tax management is the management of finances for the purpose of paying taxes. On the contrary the benefits of tax avoidance are for short term only.

Tax management is responsible for the timely filing of returns having accounts audited and. The objectives of tax planning are simple but many. Unlike tax avoidance which uses the loop holes of the law.

The essential idea of tax planning is to set aside cash and alleviate ones tax burden. Owing money to the IRS can be more than an inconvenience. Iii Tax Planning relates to future.

A tax planning strategy becomes part of an overall plan for making expenditures and allocating retirement and other savings. Taxation laws and regulations provide several ways in which a business or individual may save on the amount of tax that is to be paid. Tax management on the other hand encompasses the.

Tax Management deals with filing of Return in time getting the accounts audited deducting tax at source etc. The fourth difference is the time frame. Making use of these tax saving.

Reducing exposure to future taxes. In this type the provision is done in an intelligent way to avail the tax benefits while following a certain well-defined objective such as a change in investment. The main difference between tax planning and tax management is that tax planning is an optional exercise for tax aversion while tax management is a general term used.

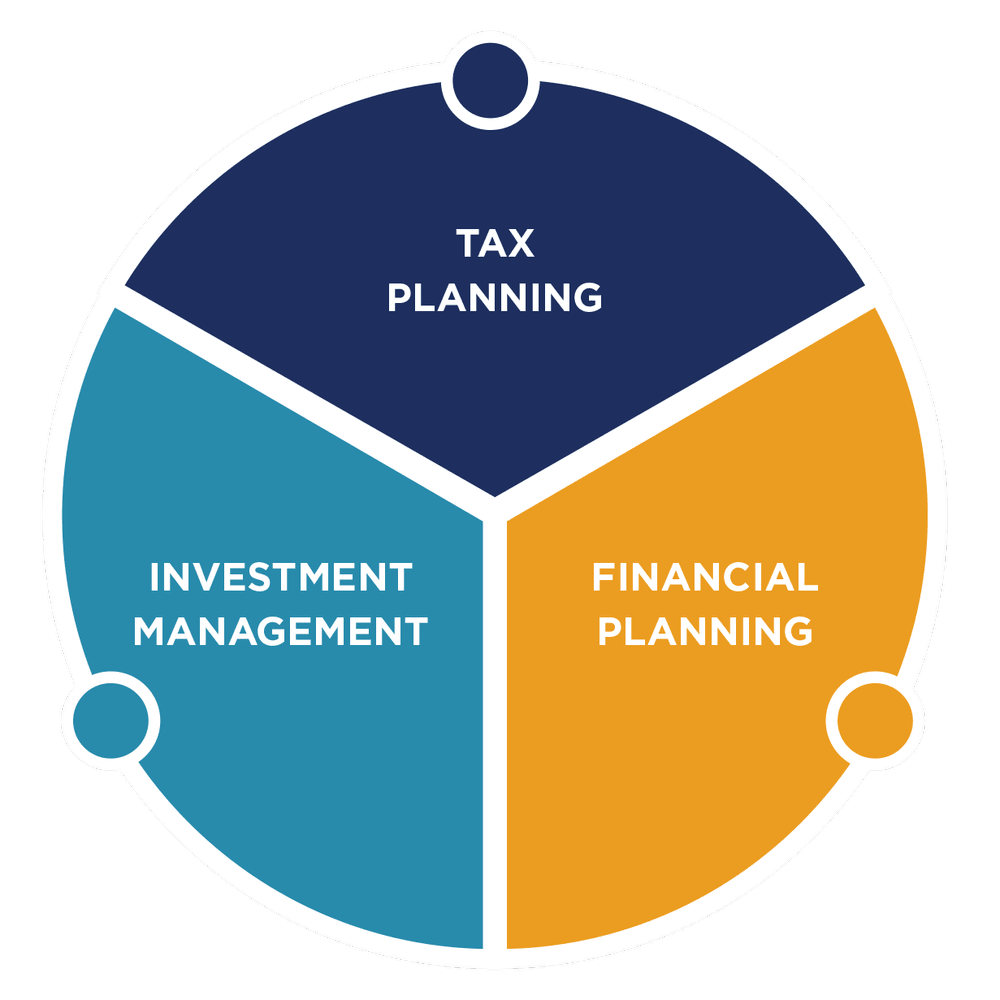

Tax Planning Tax Management. Strategic Tax Planning Management Services Mercer Advisors Why Proactive Tax Planning Is More Important Than Before Tax Planning Brooklyn Tax Return Preparation. Year-end planning isnt just about the here and now.

Investors should discuss the implications of tax mitigation. To lower your tax liability. There are several things you can do before the end of 2022 that could help reduce the.

The benefits of tax planning can be seen in the long run. While on the other hand tax management is about the proper maintenance of. Tax planning is specific for individuals Knowing the expected tax bracket is a good start for year-end planning.

Tax management is concerned with accounts and auditing and filing tax returns. Tax filing status and deductions. Tax management implies planning about situations in such a way that the tax obligation is.

Tax planning includes tax management while tax management does not include tax planning. Tax planning generally deals with the planning of taxable income and investments of the assessee. Answer 1 of 11.

Tax Planning Preperation Schwan Financial Group In Aberdeen South Dakota

![]()

3 Strategies For Retirement Tax Planning Beacon Capital Management

2021 Top 10 Year End Tax Planning Ideas For Businesses And Business Owners Key Private Bank

:max_bytes(150000):strip_icc()/wealthmanagement_final-b671bf5f78194ded9e6c6d9666266c49.png)

Wealth Management What It Is And What Wealth Managers Charge

Secure Act Navigating New Tax Planning Opportunities

Tax Planning Vs Tax Management In Tabular Form

San Luis Obispo Wealth Management Wacker Wealth Partners

Tax Optimization Tax Planning Bogart Wealth

Why Is Tax Planning Important Bc Tax

What Is Tax Planning Definition Objectives And Types Business Jargons

Small Business Tax Planning Your Basic Guide Dhjj

Tax Planning Virtus Wealth Management Wealth Manager

Tax Centered Financial Planning Raleigh Beacon Financial Strategies

Tax Planning Vs Tax Management Sjb Global Financial Pension Experts

Tax Planning Service In El Paso Tx Individual Tax Prep Marcfair Com

2022 New Year Brings New Tax Planning Sagevest Wealth Management

6 Tax Planning Tips Your Year End Tax Planning Guide Intuit Mint